Updated June 2023

In this section

Price Forecast Cases

Three cases for crude oil prices are presented in this section:

- The base-price case is a reference point based on assumptions, including a slowdown in global demand due to high inflation and monetary policy tightening, the reopening of China’s economy, the ongoing war in Ukraine, and an expected increase in global supply primarily driven by the U.S. shale output.

- The low-price case captures the lower limit of the 90 per cent confidence interval.

- The high-price case captures the upper limit of the 90 per cent confidence interval.

Highlights of 2022

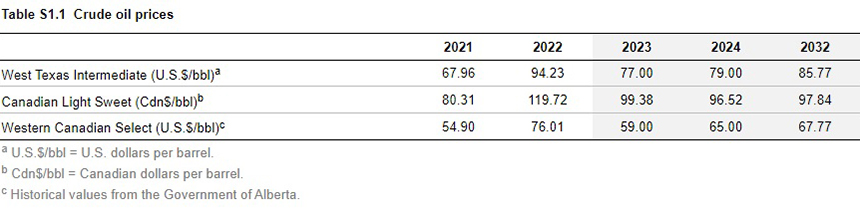

WTI: The West Texas Intermediate (WTI) price increased by 39 per cent, averaging US$94.23 per barrel (bbl) in 2022. The strong increase was due to the disruption of Russian oil supplies to Europe following the onset of the war in Ukraine.

CLS: The Canadian Light Sweet (CLS) price increased by 49 per cent, averaging Cdn$119.72/bbl.

WCS: The Western Canadian Select (WCS) price increased by 38 per cent, averaging US$76.01/bbl.

The WCS and CLS price increases mirrored the percentage increase in WTI, despite WCS being discounted more to WTI in 2022.

Table S1.1 shows historical and forecast prices for crude oil.

Highlights of 2023 to 2032

Market Factors:

Potential recession, relaxing COVID-19 restrictions in China, and geopolitical supply disruptions will affect the near-term forecast for crude oil prices. The short-term forecast will also be affected by the actions of the Organization of the Petroleum Exporting Countries (OPEC) and its allied non-member countries (collectively referred to as OPEC+) (i.e., the duration of production targets and member adherence to those targets), plus the U.S. shale industry’s response to the recent relative strength in crude oil prices.

The long-term forecast largely depends on the demand for liquid fuels. Despite advances in environmental policies, it is too early to predict a rapid decline in crude oil demand.

The forecast for 2023 assumes that crude oil prices will be shaped by a slowdown of global economic activity, China’s reopening, OPEC’s commitment to modestly decrease supply, the gradual expansion in U.S. production, and continued disruptions caused by Russia’s invasion of Ukraine. In 2024, demand is expected to rebound with the resumption of global economic growth, but crude oil production growth will hamper the WTI price. Demand for crude oil is expected to catch up to supply by 2025 as the market balances.

WTI:

- Base-price case WTI: The projected average price is US$77.00/bbl in 2023, strengthening to US$79.00/bbl in 2024. The price is expected to increase to US$85.77 by 2032.

- Low-price case WTI: The forecast is US$46.92/bbl in 2023, US$47.66/bbl in 2024, and US$47.45/bbl by 2032.

- High-price case WTI: The forecast is US$126.37/bbl in 2023, US$130.94/bbl in 2024, and US$155.04/bbl by 2032.

CLS:

- Base-price case CLS: The CLS price follows similar trends as WTI but is influenced by exchange rates and the differential to WTI. It is projected to be Cdn$99.38/bbl in 2023, easing to Cdn$96.52/bbl in 2024. The price is expected to rebound to Cdn$97.84/bbl by 2032.

- Low-price case CLS: The forecast is Cdn$63.86/bbl in 2023 and projected to be Cdn$57.67/bbl by 2032.

- High-price case CLS: The forecast is Cdn$154.67/bbl in 2023 and projected to be Cdn$165.99/bbl by 2032.

WCS:

- Base-price case WCS: The projected price is US$59.00/bbl in 2023, rising to US$65.00/bbl in 2024. The price is expected to increase to US$67.77/bbl by 2032..

- Low-price case WCS: The forecast is US$31.73/bbl in 2023 and projected to be US$32.29/bbl by 2032.

- High-price case WCS: The forecast is US$109.71/bbl in 2023 and projected to be US$142.24/bbl by 2032.

Price differentials: In 2022, the WTI-CLS price differential averaged US$2.04/bbl, and the WTI-WCS differential averaged US$18.22/bbl. Figure S1.1 shows price differentials for CLS and WCS relative to WTI.