Updated June 2023

Summary

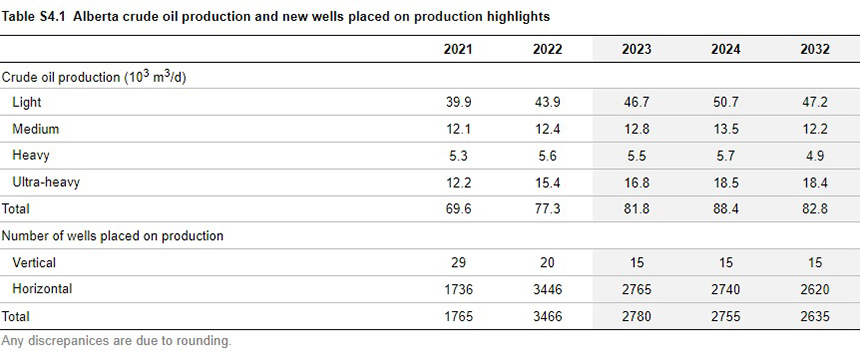

In 2022, the war in Ukraine and the resulting energy crisis in Europe led to a surge in world oil prices. Producers took advantage of higher oil prices and placed more new wells on production in 2022, resulting in an 11 per cent increase in crude oil production.

Light crude oil production accounted for 57 per cent of total crude oil production. Producers continue to target formations containing high-value light crude oil with higher initial productivity rates and quicker payouts. Producers are also increasingly targeting formations containing ultra-heavy crude oil with favourable economics.

Figure S4.1 shows the average daily production of crude oil from all wells by the Petroleum Services Association of Alberta (PSAC) area.

Production in 2022

In 2022, production increased to 77.3 thousand cubic metres (103 m3/d), 486.4 thousand barrels per day (103 bbl/d), in response to higher oil prices. This is an 11 per cent increase from 69.6 103 m3/d (437.7 103 bbl/d) in 2021.

The rise in the number of new wells supported the increase in production. Also, well performance increased because most new wells were horizontal wells completed using hydraulic multistage fracturing and benefitted from improved technology and drilling advancements for new connections (higher initial productivity and lower decline rates) (see the well activity page).

Crude oil production in 2022 consisted of (by density light to heavy)

- 57 per cent light crude oil,

- 16 per cent medium crude oil,

- 7 per cent heavy crude oil, and

- 20 per cent ultra-heavy crude oil.

Producers are increasingly commercializing formations with large volumes of light and ultra-heavy crude oil, such as the Cardium Formation, Montney Formation, and Mannville Group, because of the price premium on light oil and relatively economic ultra-heavy oil production.

Table S4.1 shows the crude oil production and wells placed on production in 2021 and 2022 and includes forecasts to 2032.

Forecast for 2023 to 2032

Based on the oil prices forecast, total crude oil production is expected to increase from 77.3 103 m/d (486.4 103 bbl/d) in 2022 to 90.5 103 m3/d (569.6 103 bbl/d) by 2025 as the number of new wells placed on production remains relatively elevated over the medium term. However, a decline to 82.8 103 m3/d (520.9 103 bbl/d) is expected by 2032 as the number of new wells placed on production will not offset the decline in existing production.

The share of light crude oil production is expected to hold steady at 57 per cent while ultra-heavy crude oil production is expected to increase from 20 per cent in 2022 to 22 per cent by 2032.

Figure S4.2 shows the average daily production of crude oil by density.

Learn More

- Methodology

- Data [XLSX]