Updated June 2023

Summary

The number of new gas wells placed on production1 in 2022 increased by 18 per cent annually, following solid growth in 2021. A significant increase in prices for natural gas and natural gas liquids (NGLs) and robust demand in 2022 boosted capital spending, increasing the number of new wells placed on production.

Figure S5.5 shows the number of new natural gas wells placed on production and the Alberta plant gate price.

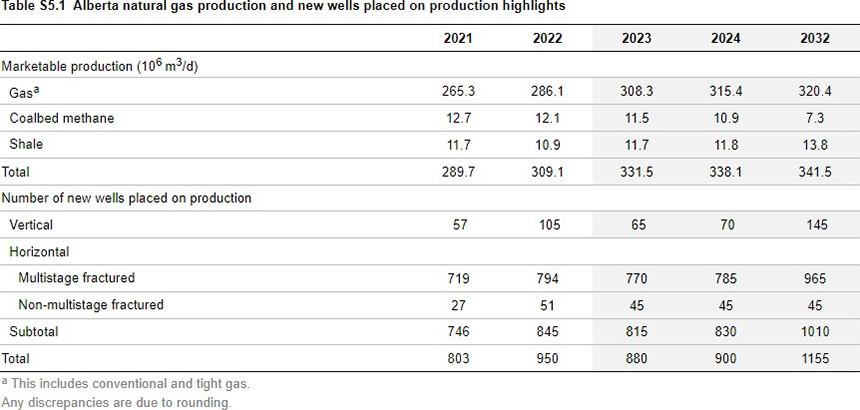

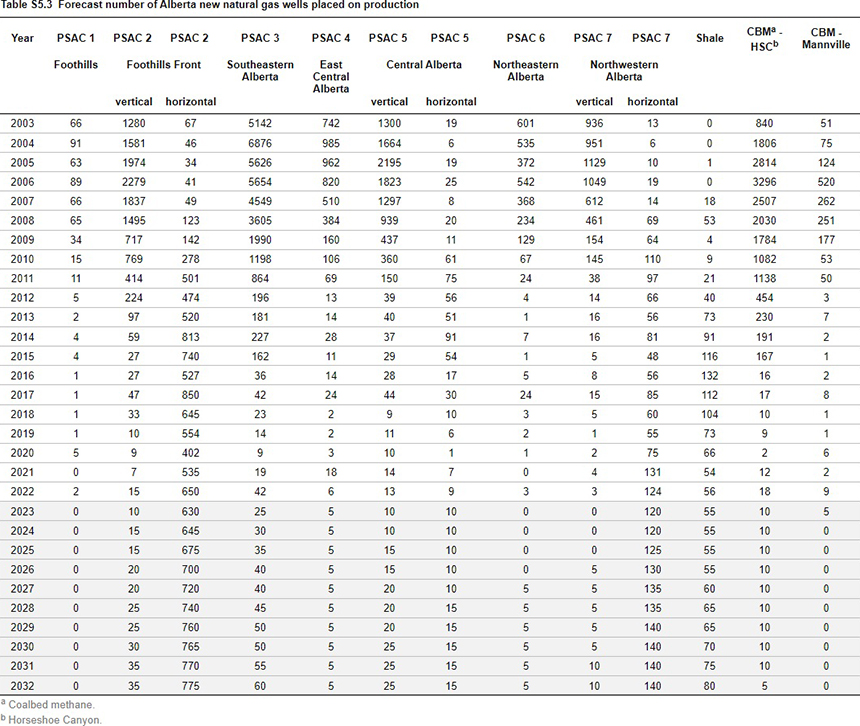

Well activity is shown by well type in Table S5.1 and by Petroleum Services Association of Canada (PSAC) area in Table S5.3

Well Activity in 2022

In 2022, 950 natural gas wells were placed on production in Alberta (Table S5.1). Horizontal wells accounted for 89 per cent of new wells, of which 94 per cent were completed using horizontal multistage fracturing (HMSF), the dominant technology since 2011. These wells use long horizontal legs to reach across large sections of the formation, increasing their productivity.

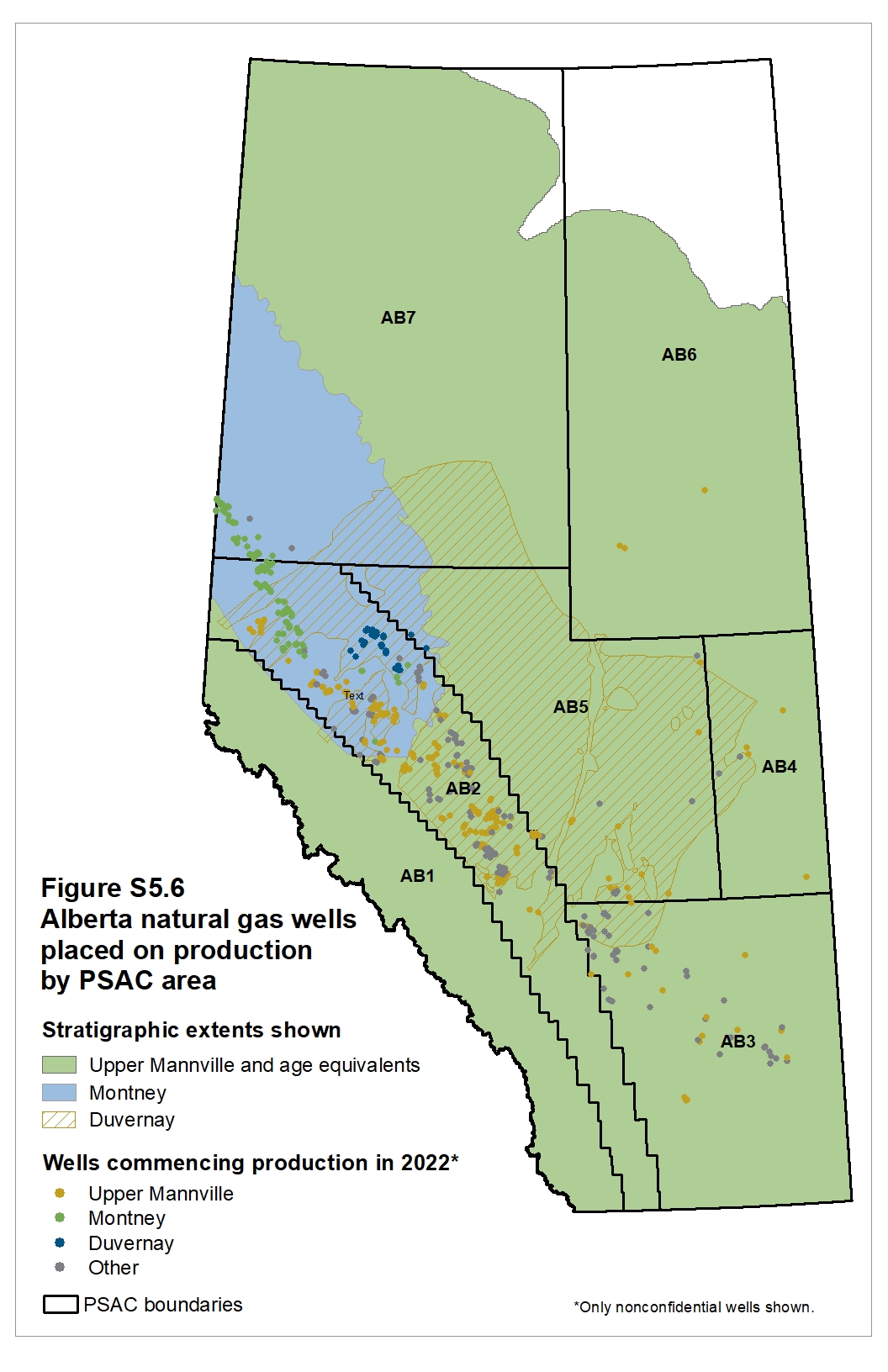

Nearly 80 per cent of all new HMSF wells placed on production were in the PSAC Foothills Front and Northwestern Alberta areas (PSAC 2 and 7). These areas have the highest levels of NGLs content in the raw gas stream and the highest productivity rates.

Eighty-five per cent of all HMSF wells (671 wells) targeted

- the Montney Formation (351 wells),

- the Upper Manville Formation (250 wells), and

- the Woodbend Group, including the Duvernay (70 wells).

Vertical wells typically target shallower formations with lower liquids content and generally have much lower productivity rates than horizontal wells. In 2022, new vertical wells in the province were primarily in the Southeastern Alberta, Foothills Front, and Central Alberta PSAC areas (PSAC 3, 2, and 5). New vertical wells placed on production as a share of all new wells placed on production slightly increased in 2022 to 11 per cent, as the price of natural gas significantly increased last year.

Table S5.1 shows Alberta’s average daily marketable gas production and number of new wells placed on production by year.

Figure S5.6 shows the distribution of wells commencing production in 2022 by PSAC area.

Forecast for 2023 to 2032

The number of wells placed on production is expected to decline slightly in 2023 before growing moderately over the forecast period. Higher prices for natural gas and NGLs, plus a positive outlook for natural gas demand, underpin this increase.

We estimate 1155 new wells to be placed on production by the end of the forecast, representing a 22 per cent increase from 2022. Over 80 per cent of the new wells will be HMSF wells and concentrated in the Foothills Front (including new shale gas wells) and Northwestern Alberta PSAC areas.

PSAC 2 and 7 will continue to be the focus of new gas developments in the province. The high liquids content of the gas and high productivity for new wells are key to their appeal, as well as access to and availability of processing and transport infrastructure and continued consolidation of operators in the areas.

Table S5.3 shows the forecast number of new wells placed on production by PSAC area.

Learn More

- Methodology

- Data [XLSX]

1 Wells that have been physically connected to gathering infrastructure and are reporting production. This includes newly drilled wells that have been placed on production and recompletions into new zones of existing wells.