Updated June 2023

The supply cost of a resource project is the minimum constant dollar price needed to recover all capital expenditures, operating costs, royalties, taxes, and earn a specified return on investment. The supply cost indicates whether a project is economically viable.

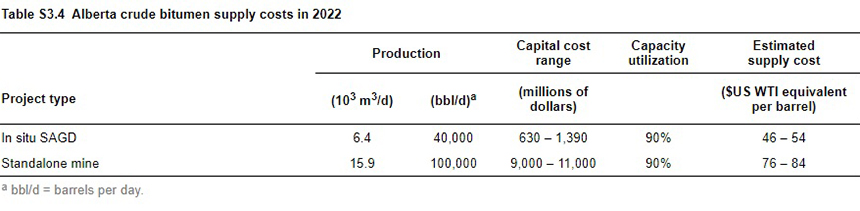

In Situ: Supply costs for in situ projects range from around US$46 per barrel (bbl) for expansion projects to US$54/bbl for greenfield projects. Lower initial capital costs support lower supply costs for in situ projects.

Mining: Supply costs for greenfield mining projects range from US$76/bbl to US$84/bbl. Despite technological innovations and other measures to lower operating costs, significant upfront capital costs for mining projects continue to challenge their economic viability.

Table S3.4 shows 2022 crude bitumen supply costs with a selection of key assumptions, such as capital costs, project capacities, and utilization rates.

Input cost data are based on 2022 Canadian dollars, whereas the resultant supply costs per barrel are converted to U.S. dollars to compare with the West Texas Intermediate (WTI) benchmark.

The supply cost estimates for 2022 include assumptions that require oil sands projects subject to the Technology Innovation and Emissions Reduction Regulation (TIER) to meet facility emission benchmarks. Facilities that do not directly meet their benchmark can also comply by submitting offsets, performance credits, or payment into the TIER fund. These carbon costs are factored into the supply cost estimates for in situ and mining projects.

Learn More

- Methodology

- Data [XLSX]

- By Topic > Oil Sands