Updated June 2023

The supply cost of a resource project is the minimum constant dollar price needed to recover all capital expenditures, operating costs, royalties, and taxes and earn a specified return on investment. Supply costs are an indicator of a project’s economic viability and are presented as the value required per unit of production.

Understanding the underlying geology allows the most effective and cost-efficient completion technology to be used. The supply cost for different geological plays and Petroleum Services Association of Canada (PSAC) areas varies significantly because of

- differing production rates,

- natural gas liquids content in the gas,

- well types,

- drilling and operating costs, and

- royalties.

Wells with a long total measured depth, typical of horizontal wells, tend to have high capital costs. However, these costs are more than offset by the high initial productivity of these wells, leading to lower supply costs.

Typically, wells that target liquids-rich gas typically have lower supply costs. As a by-product, liquids add to revenues, offsetting the costs of a well. Wells targeting liquids-rich gas are mainly in

- Foothills Front (PSAC area 2),

- Central Alberta (PSAC area 5), and

- Northwestern Alberta (PSAC area 7).

Supply Costs by PSAC Area

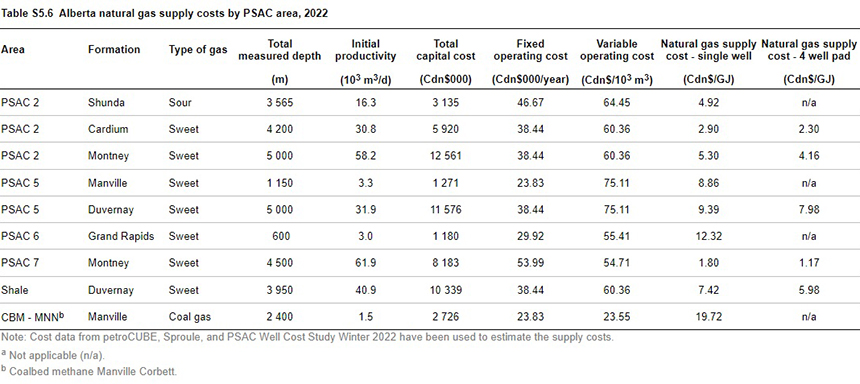

Table S5.6 shows the estimated costs for gas, shale, and coalbed methane (CBM) natural gas wells by PSAC area based on 2022 estimated costs and production profiles. Supply costs are lowest for horizontal wells in the Foothills Front and Northwestern Alberta areas (PSAC areas 2 and 7).

All areas of Alberta experienced increased natural gas supply costs in 2022. Increases in capital or operating costs or declines in production rates will increase supply costs. Supply costs decline when initial productivity rates, liquids content of the gas stream, and natural gas liquids prices increase. According to the latest PSAC well cost study, drilling and completion costs for gas wells in Alberta were, on average, 23 per cent higher than in 2021 With soaring inflation rates, North American upstream operating costs were estimated to be 7.3 per cent higher in 2022 compared with 2021. Higher natural gas liquids prices partially offset the cost increase.

Representative Wells

Supply costs are based on representative wells in each PSAC area. Results may not reflect wells that differ from the representative well profiles used in the analysis. The analysis also includes a separate set of supply costs for certain PSAC areas to reflect the industry practice of drilling more than one well or lateral leg from a well pad, commonly referred to as a multiwell pad or multilateral well. Operators of these wells can take advantage of economies of scale and cost efficiencies, resulting in lower costs per unit of output.

Recompletions were not considered in the analysis. They are substantially cheaper than new drills but have weaker initial productivity rates.

Learn More

- Methodology

- Data [XLSX]