Updated November 2023

Under the industry performance program, we annually release the Methane Performance Report. Here, we present reported data and data analysis that demonstrates what progress has been made on reducing methane emissions from upstream oil and gas.

In 2015, the Government of Alberta directed us to develop requirements to reduce methane emissions from upstream oil and gas operations. To accomplish this, we developed requirements in Directive 060: Upstream Petroleum Industry Flaring, Incinerating, and Venting and Directive 017: Measurement Requirements for Oil and Gas Operations. To learn more about these requirements, see our methane reduction page.

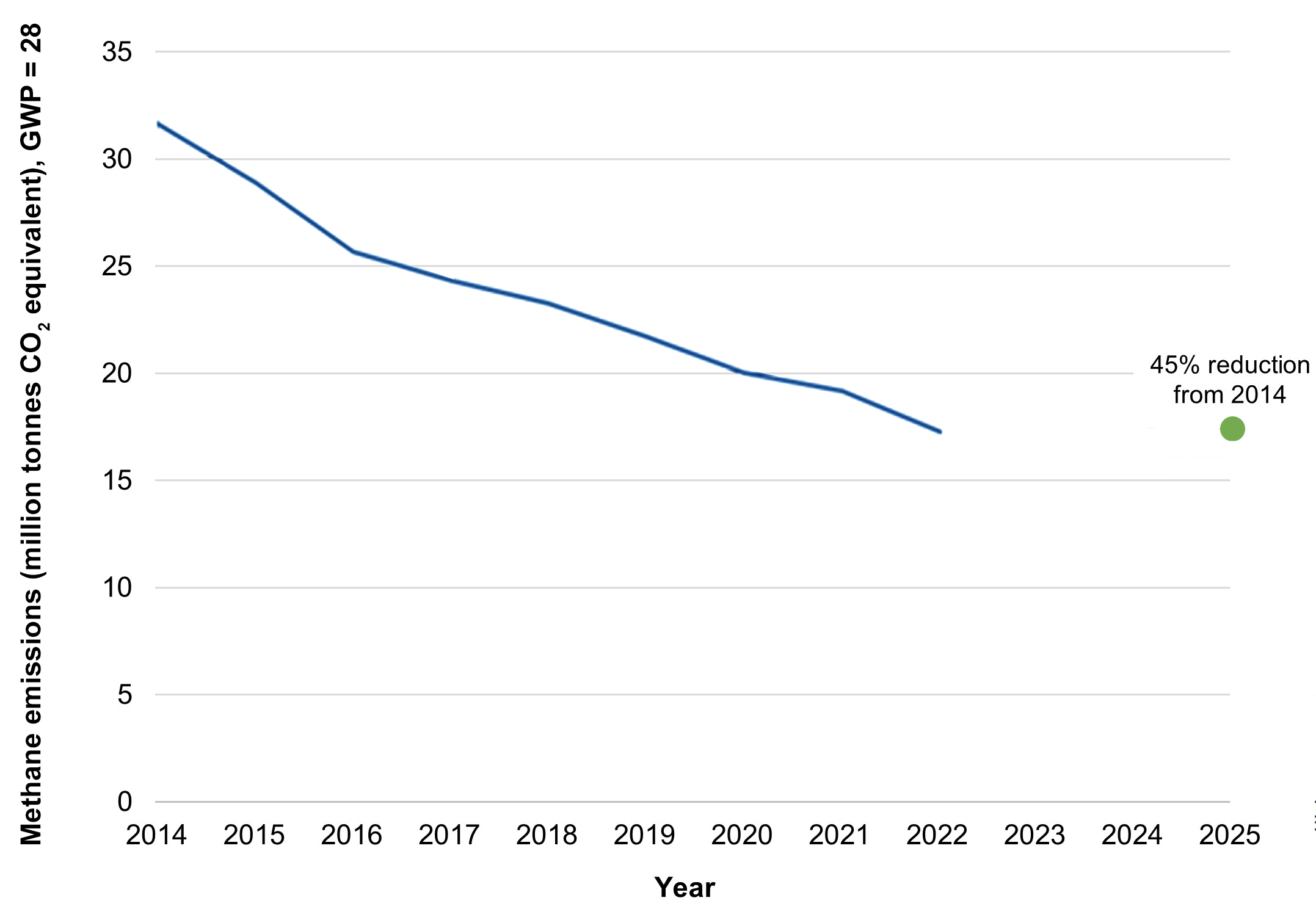

The methane emission reduction target established by the Government of Alberta was to achieve a 45% reduction in oil and gas methane emissions from a 2014 baseline by 2025. The new methane requirements have set the oil and gas industry on the path towards achieving that target. To evaluate the emission reductions achieved to date, the AER uses a combination of reported information and emission estimates. Estimation is required for sources where reporting volumes are either incomplete or are not submitted as part of the requirements.

The figure below shows that Alberta’s oil and gas methane emissions are estimated to have been reduced by approximately 45% between 2014 and 2022.

Most of the methane reductions shown here occurred before the Directive 060 methane requirements came into effect. These reductions are the result of improved industry practices and early action driven through programs like the Alberta Offset System, direct funding programs, and the new methane reduction requirements.

The estimates reflect the best available data at the time and may not align with emission estimates conducted by other parties. The AER will continue with compliance assurance activities and data quality assessments to improve our understanding of the emission baseline in 2014 and current methane emission levels. As data quality improves, the AER will continue to shift towards using reported data when possible and minimize the reliance on estimation over time. The AER will evaluate the emission reductions annually, as part of this publication.

Additionally, the AER has completed the regulatory review of Directive 060, which will be published in the coming months.