Updated June 2023

Summary

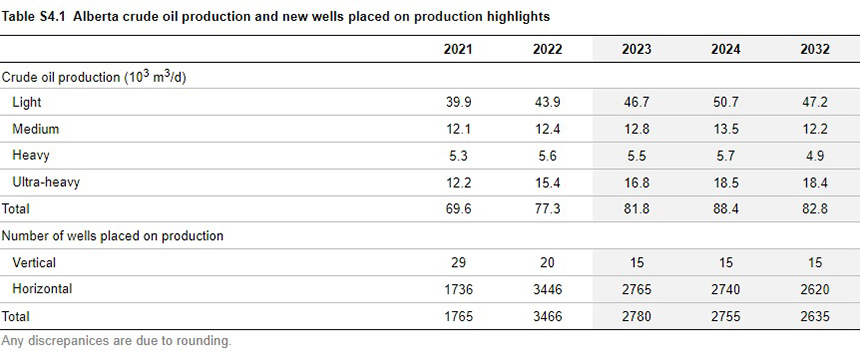

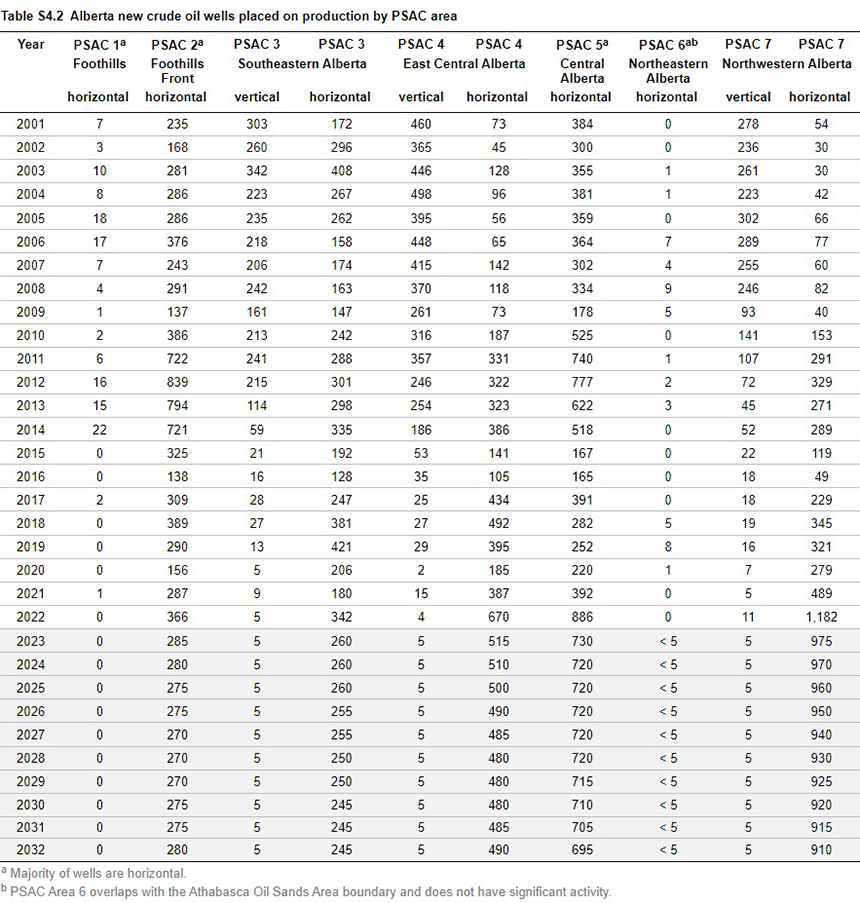

The number of new wells placed on production increased by 96 per cent in 2022 due to operators responding to higher oil prices because of a global supply shortage. However, the brisk pace of interest rate hikes by central banks worldwide to combat inflation has begun a pullback in global oil demand. The number of new wells placed on production is projected to decrease by 20 per cent in 2023 as prices ease with cooling demand. From 2023 to 2032, activity is expected to remain well above 2021 levels, supported by slowly rising prices, providing some incentive to drill new wells. However, companies’ drilling plans are not expected to expand over the forecast period due to companies continuing to exercise capital discipline.

Figure S4.3 shows the average daily production of crude oil and the number of new wells placed on production.

Well Activity in 2022

In 2022, 3466 new crude oil wells were placed on production compared with 1765 in 2021. Increases in drilling activity were due to higher commodity prices. Along with the number of new wells placed on production, the average well length continued to increase, supporting higher productivity rates. In 2022, of all the new wells placed on production,

- 20 (less than 1 per cent) were vertical wells (a 31 per cent decrease from 2021), and

- 3446 (over 99 per cent) were horizontal wells (a 99 per cent increase from 2021).

Table S4.1 shows the crude oil production and wells placed on production in 2021 and 2022 and includes forecasts to 2032.

Demand for crude oil is expected to remain relatively flat over the forecast period. However, despite higher prices, producers continue their disciplined capital spending by focusing on optimizing existing assets, reducing debt, and paying dividends to shareholders. Producers investing in new wells either targeted high-value light density crude oil or ultra-heavy crude oil that requires lower capital costs to place on production.

Producers continued to cut costs through advancements in drilling and completion, allowing some producers to drill longer wells in less time at a lower cost per metre. For horizontal wells using hydraulic multistage fracturing, the increased fracturing stages per well, longer well lengths, and multiple lateral legs resulted in higher production rates and slower decline rates.

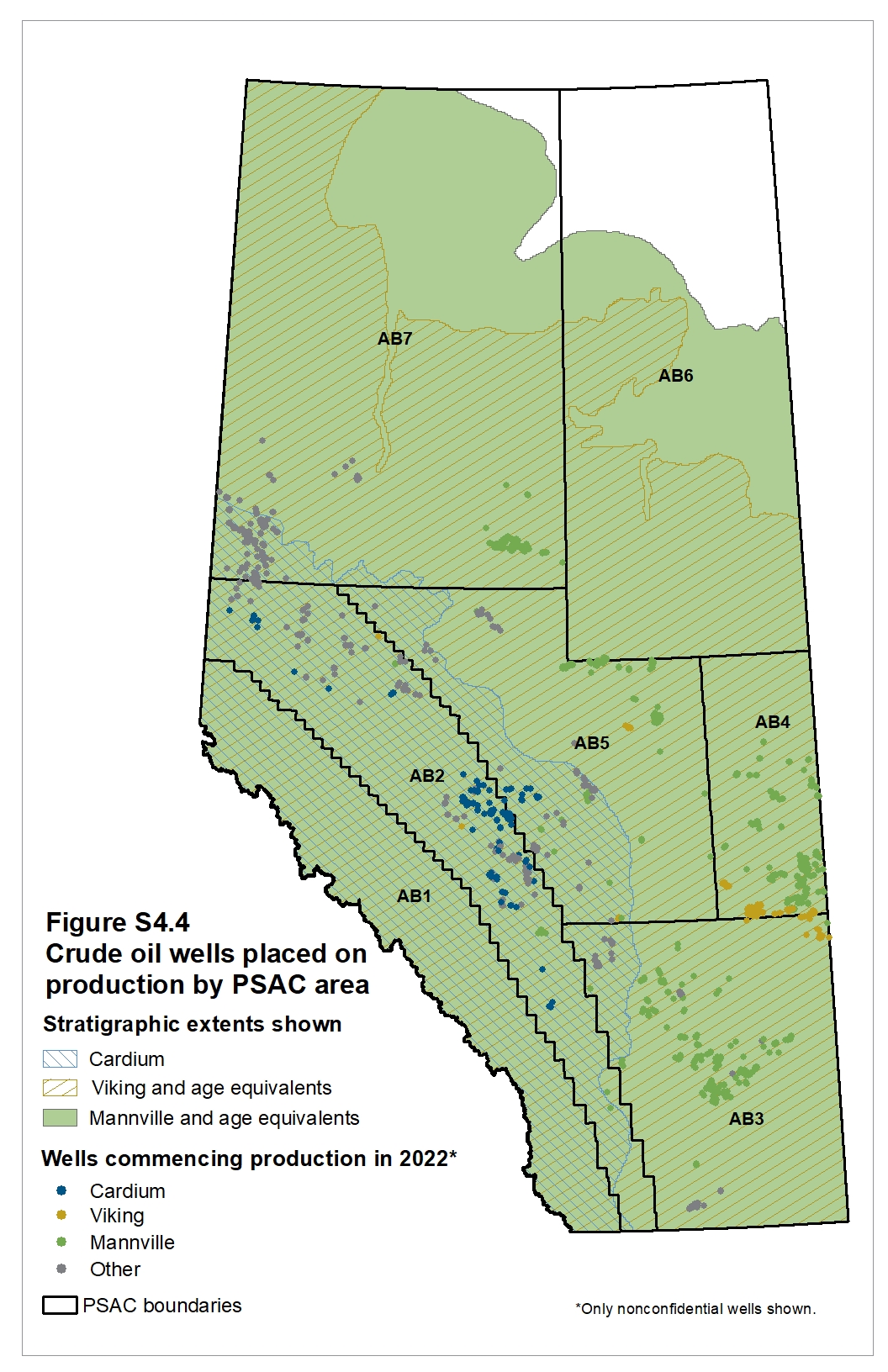

Figure S4.4 shows the wells placed on production in 2022 by Petroleum Services Association of Canada (PSAC) area and their distribution in the Cardium Formation, Viking Formation, and Mannville Group.

Forecast for 2023 to 2032

The total number of new oil wells placed on production is expected to average 2690 from 2023 to 2032. However, the number of total wells on production is projected to be less than the highs reached between 2010 and 2014 (Figure S4.5) because of relatively lower oil prices and that fewer vertical wells are being drilled in favour of longer and more productive horizontal wells. Producers are expected to continue targeting light crude oil because of its higher economic value or ultra-heavy crude oil due to more economic wells. Drilling activity is expected to remain robust in the Cardium Formation, Montney Formation, and Mannville Group.

Table S4.2 shows the number of new wells placed on production for crude oil by PSAC area and includes forecasts to 2032.

Learn More

- Methodology

- Data [XLSX]